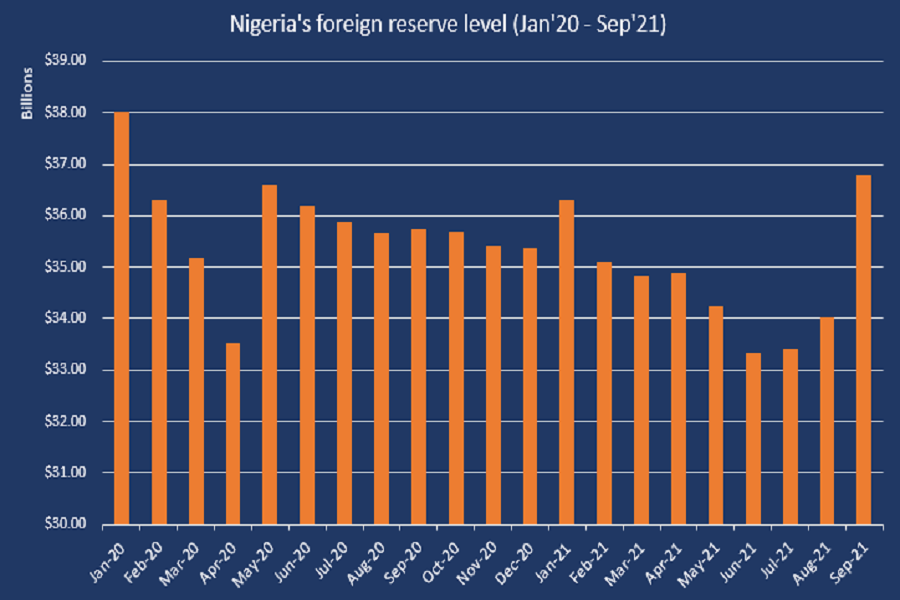

Nigeria’s foreign reserve received a boost of $2.76 billion in the month of September 2021 to close at $36.78 billion as of the end of the month. This is according to data tracked by Nairametrics from the Central Bank of Nigeria (CBN).

This gain represents the highest monthly gain recorded since May 2020, when the reserve gained $3.07 billion in a single month. Notably, Nigeria’s foreign reserve increased by 8.13% from $34.02 billion recorded as of August 2021 to $36.78 billion in the review month.

Similarly, the external reserve has gained a sum of $1.41 billion year-to-date compared to $35.37 billion recorded as of the end of 2020, representing a 4% increase between January and September 2021.

It is worth noting that an increased foreign reserve comes as good news to the economy as it means the apex bank has more foreign exchange at its disposal to intervene in the forex market which in essence reduces the pressure on the country’s exchange rate.

According to the CBN, foreign exchange reserves are assets held by a monetary authority in foreign currencies, which are used to back liabilities and influence monetary policy. They include foreign banknotes, deposits, bonds, treasury bills and other foreign government securities.

As at November 2020, when Nigeria’s reserve was at $35 billion the CBN governor, Godwin Emefiele noted that the reserve is sufficient to cover 7 months of goods and services import. He made this known in a speech at the 55th Annual Bankers Dinner Organized by the Chartered Institute of Bankers of Nigeria, held in Lagos.

The increase is in line with recent projections putting Nigeria’s external reserve at $40 billion following the $3.35 billion direct allocations approved by the International Monetary Fund, the prospects of raising funds from the international debt market, and the bullish crude oil prices.

Reasons for the boost

Crude oil rally

The foreign reserves of Nigeria as an oil-dependent economy will in most cases move in tandem with global crude oil prices. During the periods of high oil prices, Nigeria recorded a favourable trade balance, increased foreign reserve and stability in the exchange rate. However, during crashes in oil prices, we often experience serious downturns, especially exchange rate depreciation.

For example, during the crash in global oil price in 2015, Nigeria’s exchange rate depreciated from N231/$1 to N305/$1. The same thing also happened in 2020 when the price of crude oil dipped to record lows due to the covid-19 pandemic, Nigeria recorded multiple devaluations to about N406/$1 at the Investors and Exporters window.

Meanwhile, an analysis of the crude oil price and external year-to-date, shows that Bonny Light, Nigerian crude gained over 53% from $50.59 per barrel to about $77.54 per barrel at the end of September 2021, while the country’s reserve has also gained a 4% boost. Similarly in the review month, Bonny Light gained 9.8% in price while Nigeria’s external reserve gained 8.13% in September 2021.

Ban on sale of forex to BDCs

Recall that on July 27th 2021, the Central Bank discontinued the sale of forex to Bureau De Change (BDC) operators in the country, due to the illegal forex trading carried out by these operators. The nation’s reserve has gained over $3 billion since the ban on these sales.

The governor noted during the MPC briefing in July that the BDCs were now contravening the operational model prescribed for them by the apex bank which provided a window for them to make a decent margin from the sales of the US dollar allocated to them by the CBN. The CBN governor alluded to the BDCs becoming greedy by making an abnormal profit at the detriment of the nation’s exchange rate. According to him, these actions have placed a significant financial burden on the apex bank, and hence necessitated the halt of forex sales to the BDCs and suspension of new license issuances.

The governor of the apex bank explained that the CBN sold over $20,000 to more than 5,000 BDCs per day, which translated to about $110 million per week and $5.72 billion in a year.

Nigeria’s Eurobond sale

In September, Nigeria raised $4 billion from the international debt market through its Eurobond issuance which was oversubscribed. The issuance was dubbed one of the biggest financial trades to come out of Africa yet in 2021.

The disclosure, which was made known by the Debt Management Office, revealed that the Order book peaked at $12.2 billion, thus enabling the Federal Government to raise an additional $1 billion more than the intended $3 billion initially announced.

Details of the issuance show that the debt was issued in three tranches, raising $1.25 billion for 7 years at a yield of 6.125%, 12 years at 7.375% with $1.5 billion and a 30-year tenor at 8.25% yield which raised $1.25 billion.

Although there is no clear indication if these funds have found their way into the country’s reserve, it is clear that the reserve received a significant $785.84 million on the 4th of October 2021, to close at $37.57 billion.

While the external reserve continues to record positive growth, it is worth noting that Nigeria’ exchange rate has recorded significant depreciation at the official Investors and Exporters window, dropping by 1.09% from N410.25/$1 to over N414/$1.

According to data tracked from FMDQ, a total of $4.39 billion was traded at the official window in the month of September, significantly above the $2.82 billion and $2.81 billion recorded in August and July 2021 respectively.

Bottomline

An increased external reserve will help boost the CBN firepower to stabilize the exchange rate as well as meet up with pent-up obligations, accumulated due to the covid-19 lockdown in 2020.

Source: nairametrics